capital gains tax increase retroactive

The original House bill proposed a new top rate on capital gains and dividends of 25 for individuals with more than 400000 in income but the proposal was dropped from the version passed by the House on November 19. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

With no tax law changes your client would expect capital gains tax.

. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. Retroactive tax rate decreases unsurprisingly tend to be more welcomed by the public.

The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

At this point though its looking like the earliest the Biden tax plan will be passed is. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. The capital gains tax.

The Administration leaked Thursday that its new high rate would apply to all gains. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Hike to the capital gains inclusion rate may occur in the next federal budget.

If a change to the capital gain inclusion rate is announced in the upcoming budget it is not known whether it would be effective immediately be retroactive or start at a future date. Reduced the maximum capital gains rate from 28 percent to 20 percent. In some cases you add the 38 Obamacare.

The only major capital gains rate increase since 1980 was not made retroactive. Signed 5 August 1997. June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that.

Will the capital gains tax increase be retroactive. President Joe Bidens tax policy proposal had many items including increasing the long-term capital gains tax to. Since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. However based on Supreme Court precedent the validity of a retroactive tax increase under the Due Process Clause depends primarily on whether 1 the provision is illegitimate or arbitrary and 2 the period of retroactivity is excessive. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary. Even if legal retroactive tax rate increases can be politically unpopular amongst constituents and lawmakers alike for obvious reasons. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year.

A Multimillion-Dollar Sale No. The seminal case on this issue is United States v. This would mean actions taken now which under the current tax.

Are retroactive tax increases constitutional or even fair. If you would like to plan for a potential increase in the inclusion. Thus the capital gains tax excluding the surtax for 2020 would be 800000 20 times 4 million.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

2021 2022 Proposed Tax Changes Wiser Wealth Management

![]()

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Corporate Law Marketing Jobs Medicaid

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

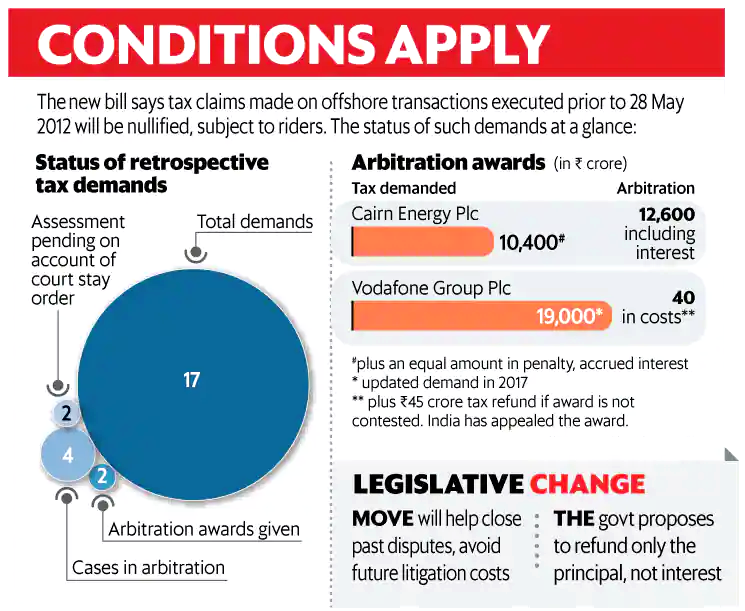

Doing Away With Retrospective Taxation